Protective Life Insurance

Experience Strategy & UX Design for Quality Improvement Web App

An efficiency increasing web application for Protective Life Insurance company to create and distribute accurate rates data to their bank partners every week.

The internal process for Protective to create and distribute rates information to their bank and broker partners was archaic and very cumbersome. Rate sheets (pdfs with rate information) are updated with new rates and sent out every week to those who sell their annuity products. Their process was very inefficient to the point where employees didn’t even know the process or who was involved with which part. To alleviate this weekly task, we created a product where the user can create rate sheets, manage who they are being sent to and set events to automatically release the information.

Problems to Solve

A long one month cycle to create new products & sheets

Products are difficult to update & change across sheets

New products overlap with the old versions by having the same product placed on different sheets being sent to different recipients

Marketing and compliance content is difficult to change across sheets

Accurate rate decrease information and their effective dates is not clearly communicated

Distribution process is manually handled every week

Sending off cycle emails or one-off emails problematic

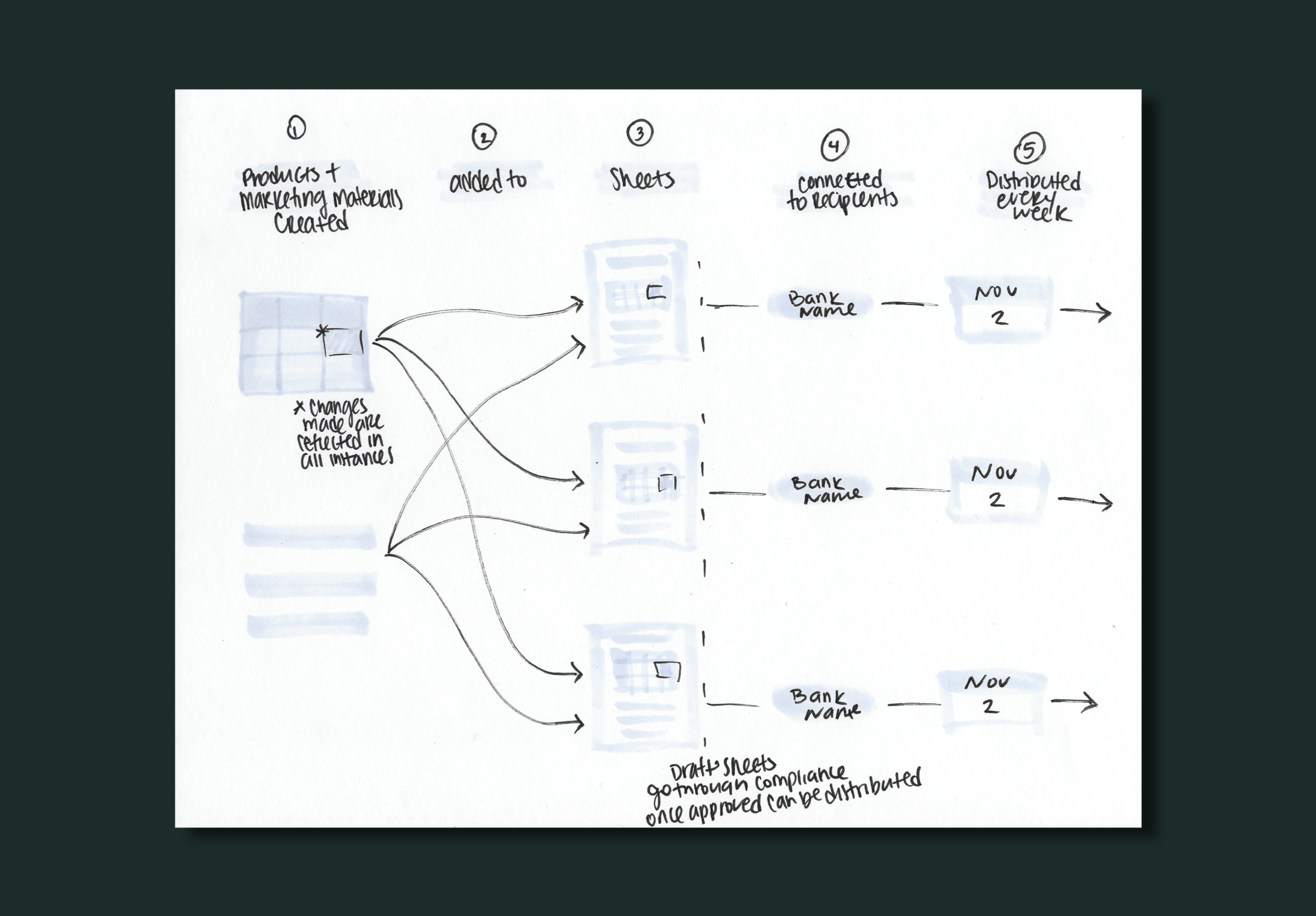

sketch of service blueprint findings

Within their current system, Protective designs and manages all changes to products or sheet information within 100s of Indesign files. This process to creating and maintaining sheets within Indesign created a lot of inconsistencies, inaccuracies and a very manual process when content needed to be updated across sheets. Protective needed a product that allows them to create rate sheets, easily make updates and have shared visibility in one place. Similar to Protectives current creation of rate sheets, it was also a very manual process each week to trigger the rate information to be distributed. A single person every Friday and Monday, would go through all of the rate sheets to make sure the correct rates had been entered in prior to manually sending it to Salesforce to then be distributed. Overall, their internal process needed to be overhauled.

In order for us to completely understand the current problems and process, we conduct a months worth of research with stakeholder interviews, value proposition workshop, and current and future state service blueprinting. As we were conducting the interviews, we began to realize how manual their process was. We were uncovering problems and holes within their system they didn’t even know existed. When concluding the stakeholder interviews to understand the ins and outs of the different parties, we were able to paint a picture of their entire process within a Service Blueprint. This exercise was eye opening to Protective since they had never seen a complete representation of the end to end process. Through doing this, we were able to land on what updates would provide the most value to them and construct what a future state vision would be.

annuity rate marketing tool workflow

Our solution was to build a create section of the tool that allows a Protective employee to come in and create the building blocks (product tables, marketing content and legal information) of a sheet. By breaking down the different elements of a sheet into smaller pieces that come together, allows the tool to support making changes quick.

For example, products are represented in the form of a table. These tables are then placed within sheet. A sheet can be one single product or multiple combined. The way the tool works is it allows the user to build a product and then place it on as many unique rate sheets. If the user needed to make an update to a products information, they would only need to make that update once for it to be translated onto all of the sheets that product is placed on. This simple decision, cuts down on the months of manual updates in Indesign files and speeds up compliance approval.

For distributing, we built a system that allows the user to connect rate sheets to distribution lists, and create events for when the information will be distributed, with the option for it to be an automatic or manual approval release. This structure, allows the user to decide if they need to review all the materials going out, or they can simply let the tool run on its own. This ability to set up as an automatic release, a single employee no longer has to spend 5-8 hours a week reviewing and prepping materials for release.

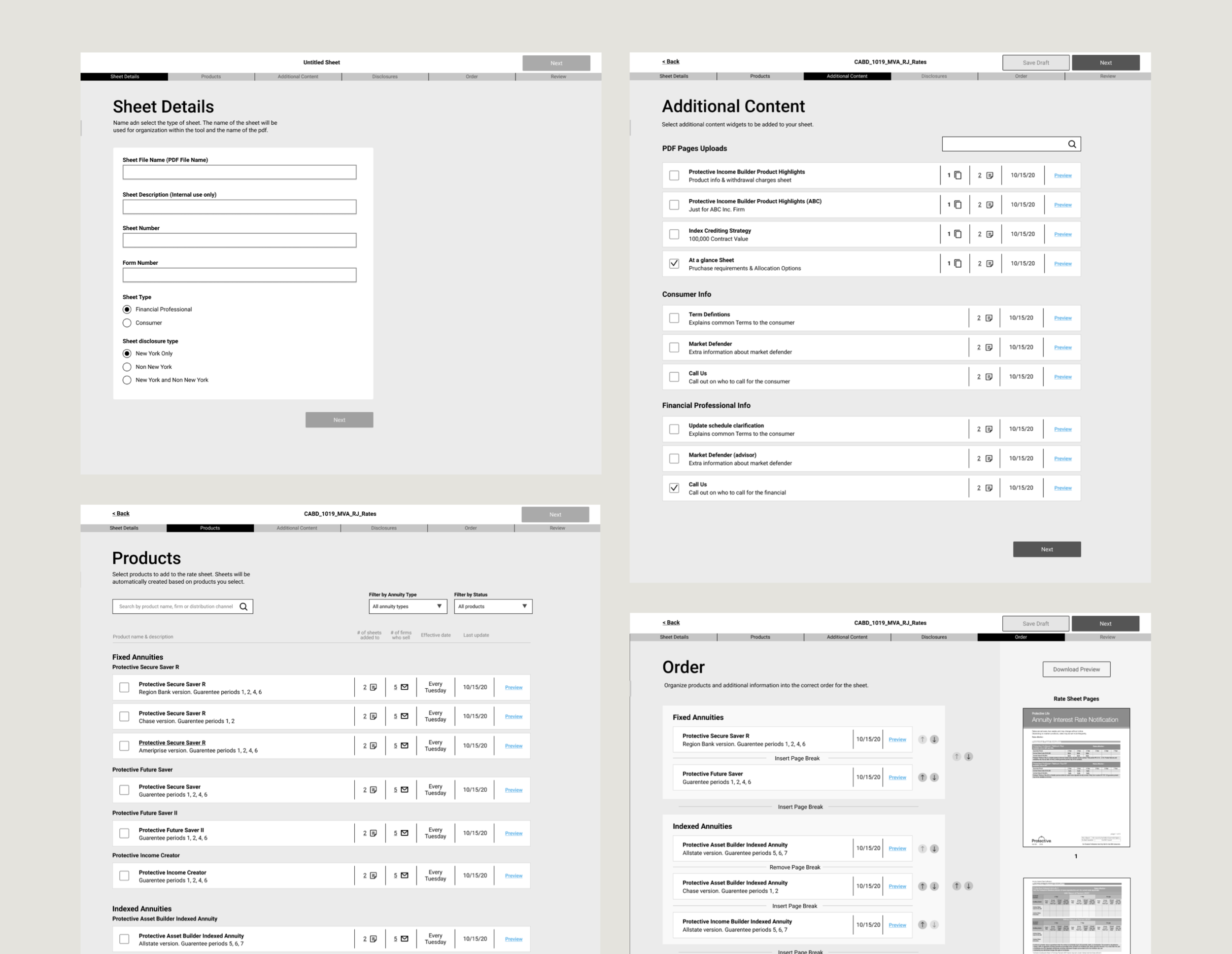

create a product steps

Create a Product

Created a step by step builder (product details, rate table, footnotes, disclaimers and rate effective date) to developing a product table. All of this is combined together to create a product. The user saves the product as a draft to be temporarily added to a sheet for compliance review. Once a product has been approved by compliance the user can publish the product to then activate it into the sheet. Anytime an update needs to be made to a product, the user only needs to make the update once and it will be translated on any of the materials that the product is located.

pulling in rate keys to add to rate table

Connecting Rate Keys

Once the user has been provided the green light that rate keys have been created for a product, from the Protective Actuaries, the user can add rate keys to the accurate cells within the rate table. Adding this key allows for the tool each week to automatically collect rates from the database and place the current rates into the appropriate cells of a product. Protective no longer needs to manually make sure the correct information is being placed each week.

create a sheet steps

Constructing a Sheet

The material that financial advisors receive is a pdf of the product(s) they sell in the form of a Rate Sheet. To create a rate sheet, the user goes through a series of steps (sheet details, selecting products, adding marketing content, disclaimers and reviewing) to construct a sheet. Once the sheet has been constructed, the user can save the sheet as a draft or publish. Within Protective’s workflow, they typically produce rate sheets within a draft state to go through the compliance approval process. Once all the required information is entered in and a rate sheet has been approved, the user can publish the sheet and it is now activated to be distributed.

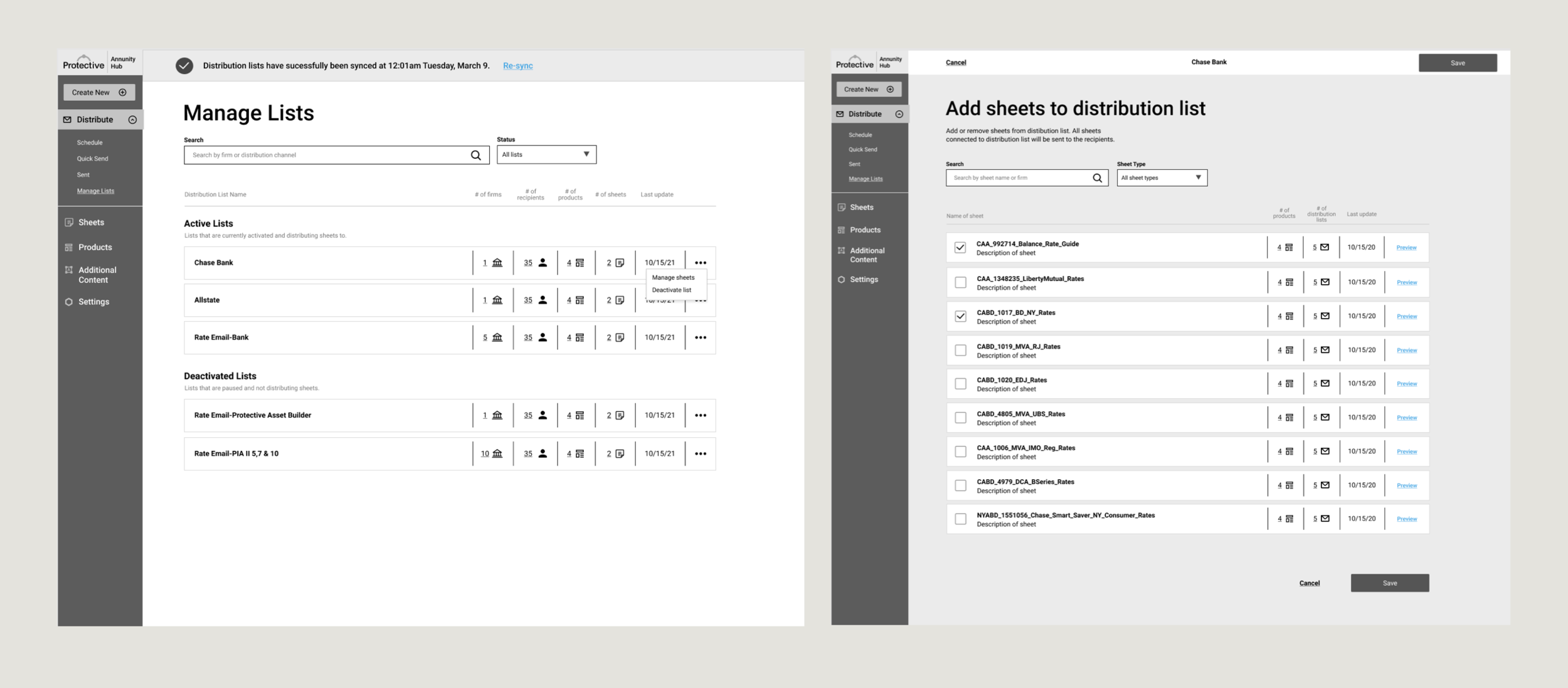

managing what sheets are sent to recipients

Connecting Rate Sheets to Recipients

Protective manages their marketing recipient lists within Eloqua which are pulled into the Annuity Rates Marketing Tool. The user can select what lists will receive which sheets by attaching sheets to a marketing recipient list. Once this is done, the user will see this reflected as they create events to trigger rate sheet distribution.

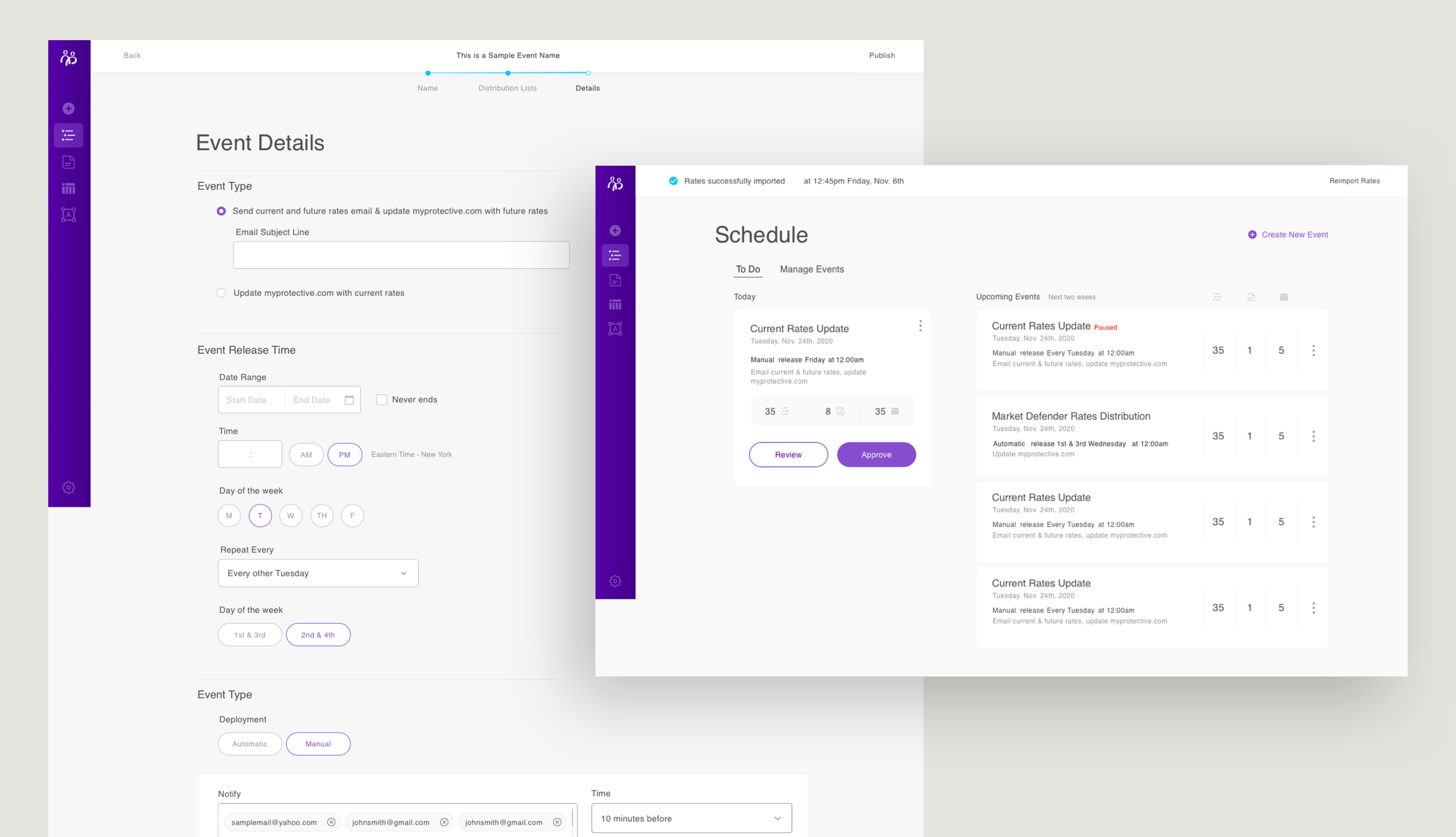

create and manage events

Scheduling and Releasing a Distribution Event

Once rate sheets are connected to the appropriate recipient, the user needs to go in and create an event for when the materials will be sent to those recipients. To create this event, the user will go through a set of steps of selecting the recipients, the rate sheets and setting up the time and type of event. This process is similar to setting up an occurring calendar event, once it is scheduled it will continue to be released according to the settings of the event. The user has the option to do automatic releases or manual approval releases.

For one off sending of rate materials, the user has the ability to select a distribution list or add receipts, select the rate sheets and write an email to be sent at anytime. This helps elevate instances where information was miscommunicated and needs to be resent with an explanation or when a certain product wants to be featured to a certain audience.

Team

UX Strategy and UX Design Lead | James Dean

UX Strategy and UX Design | Katie Larson

Design Lead | Leah Cranston

Development Lead | Christian Delprete

Front End Developer | Michael Smith